Navigating the world of trading can be intimidating, especially with so many options available. One trading method that’s gained popularity is CFD (Contract for Difference) trading. But how do you know if CFD trading is suitable for you? This blog post will break down what CFD trading is, its benefits and drawbacks, and help you determine if it aligns with your financial goals and risk tolerance.

What is CFD Trading?

CFD trading allows you to speculate on the rising or falling prices of fast-moving global financial instruments such as shares, indices, commodities, currencies, and treasuries. Unlike traditional stock trading, you don’t own the underlying asset. Instead, you enter into a contract with a broker to exchange the difference in the asset’s price from the time the contract opens to when it closes.

How Does CFD Trading Work?

When you trade CFDs, you can go long (buy) if you think the price will rise or go short (sell) if you think the price will fall. The profit or loss you incur is determined by the difference between the opening and closing prices of the contract.

No Ownership of Assets

One key feature of CFD trading is that you never actually own the asset. This means you can speculate on price movements without the costs and process associated with owning the asset itself, such as stock ownership.

Leverage and Margin

CFD trading often involves leverage, meaning you can open positions with a smaller amount of capital than the actual value of the asset. This can amplify gains, but it also comes with higher risk, as losses can exceed your initial deposit. Understanding margin requirements and how leverage works is crucial before engaging in CFD trading.

Benefits of CFD Trading

CFD trading offers several advantages that may appeal to certain traders. Let’s explore some of these benefits in more detail.

Access to Global Markets

CFDs provide access to a wide range of global markets from a single platform. This means you can trade different assets, including stocks, commodities, and currencies, all in one place, giving you diversified trading opportunities.

Flexibility to Go Long or Short

With CFDs, you have the flexibility to profit from both rising and falling markets. This is unlike traditional investing, where you generally benefit only when prices go up. This ability to short-sell can be particularly useful in volatile or bearish markets.

Cost-Effective Trading

Since CFD trading does not involve ownership of the underlying asset, you avoid costs such as stamp duty, which is applicable in some countries when buying shares. Additionally, brokers often offer tight spreads and low commissions, making it a cost-effective way to trade.

Drawbacks of CFD Trading

While there are benefits, it’s also essential to consider the potential downsides. Here are some drawbacks associated with CFD trading.

High Risk Due to Leverage

The use of leverage in CFD trading can amplify both gains and losses. It’s possible to lose more than your initial investment, which makes risk management crucial. Traders must be aware of the risks and have a strategy in place to mitigate potential losses.

Potential for High Costs

Though CFD trading can be cost-effective, there are still costs to consider, such as overnight financing fees for positions held longer than a day. These costs can add up, especially if you hold positions for extended periods.

Regulatory Concerns

CFD trading is not permitted in some countries, and the regulatory environment can vary. It’s important to ensure that you are trading with a reputable broker and are aware of the regulations governing CFD trading in your region.

Assessing Your Risk Tolerance

Before engaging in CFD trading, it’s crucial to assess your risk tolerance. Here are a few questions to ask yourself to determine if CFD trading aligns with your comfort level regarding risk.

Can You Afford to Lose?

The first question to consider is whether you can afford to lose the money you plan to invest in CFD trading. Given the high-risk nature of leverage, it’s possible to incur significant losses, and you should only trade with capital you can afford to lose.

Are You Comfortable with Market Volatility?

CFD trading often involves speculating on highly volatile markets. If you are uncomfortable with dramatic price swings and the uncertainty they bring, CFD trading may not be suitable for you.

Do You Have a Risk Management Strategy?

A solid risk management strategy is essential for CFD trading. This includes setting stop-loss orders, determining position sizes, and having a clear plan for exiting trades. Assess whether you have the knowledge and discipline to implement and stick to such a strategy.

Understanding Your Financial Goals

Aligning CFD trading with your financial goals is another critical factor. Consider how CFD trading fits into your overall investment plan and objectives.

Short-Term vs. Long-Term Goals

CFD trading is typically more suited for short-term trading due to the costs associated with holding positions overnight. Determine whether your financial goals align with short-term trading strategies.

Income Generation vs. Capital Growth

Decide if you are looking to generate income or grow your capital. While CFD trading can offer opportunities for both, it’s important to have a clear understanding of your primary objective.

Diversifying Your Portfolio

Consider how CFD trading fits into your broader investment portfolio. Diversification is key to managing risk, and CFD trading should be just one component of a diversified investment strategy.

Choosing the Right Broker

Selecting a reputable broker is essential for successful CFD trading. Here are some factors to consider when choosing a broker.

Regulation and Licensing

Ensure the broker is regulated by a reputable financial authority. This provides an additional layer of security and ensures that the broker adheres to industry standards.

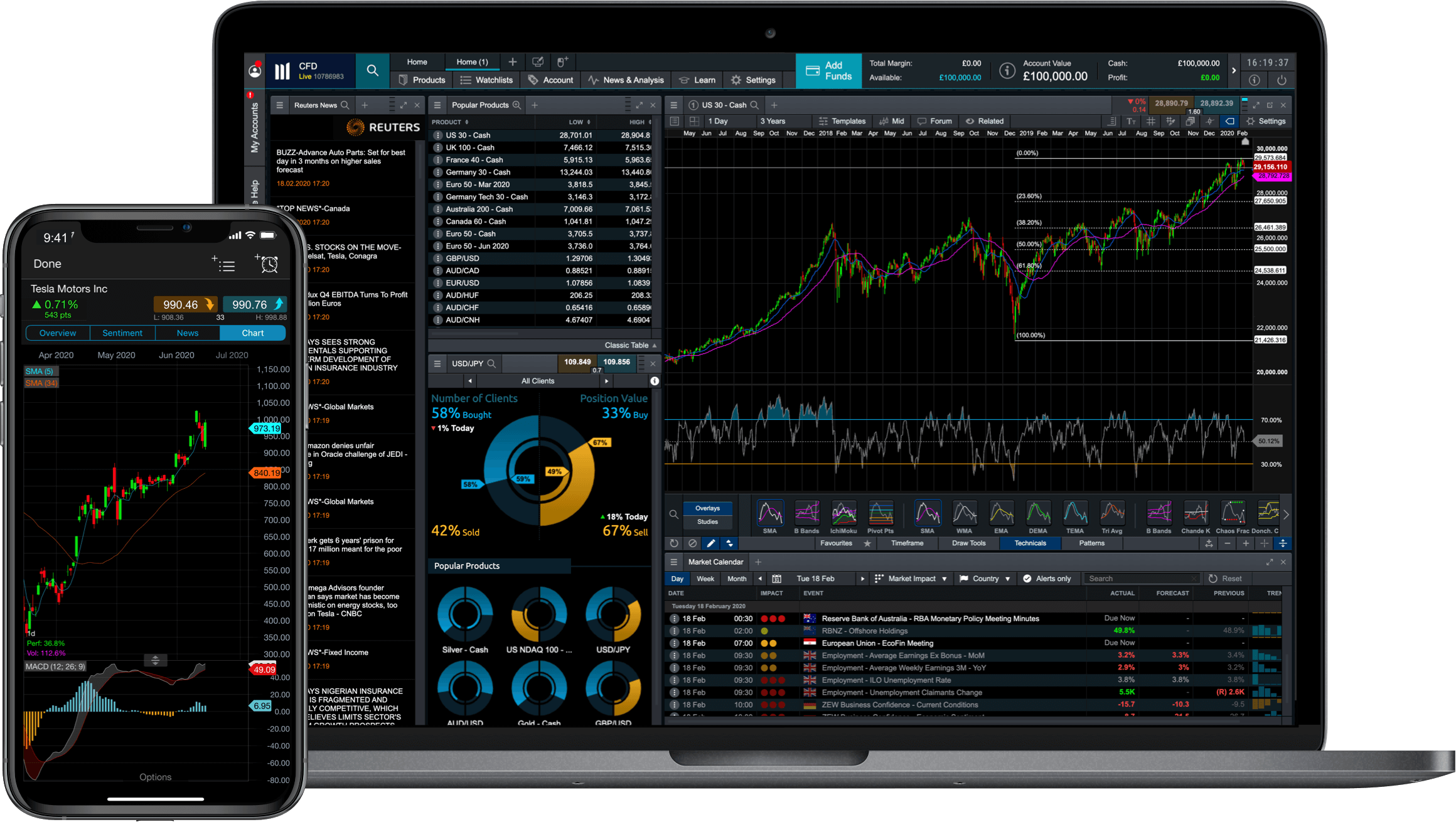

Trading Platform and Tools

The quality of the trading platform and tools offered by the broker can significantly impact your trading experience. Look for a platform that is user-friendly and provides the necessary tools for analysis and risk management.

Customer Support

Good customer support is crucial, especially for new traders. Ensure the broker offers responsive and helpful customer service to address any issues or concerns that may arise.

Conclusion

CFD trading offers exciting opportunities for traders looking to speculate on various global markets. However, it comes with its share of risks, particularly due to leverage. By assessing your risk tolerance, understanding your financial goals, and choosing the right broker, you can make an informed decision about whether CFD trading is suitable for you. Always start with a clear strategy and be prepared to adapt as you learn and grow as a trader.

Note that while this blog post outlines the key factors to consider when deciding if CFD trading is right for you, it’s important to continue your research and consult with financial advisors to ensure it aligns with your personal circumstances and goals. Happy trading!