In the world of CFD trading, staying ahead of market trends is crucial. One significant event that can greatly influence stock prices and trading strategies is the release of earnings reports. Understanding how these reports affect CFD stock trading can help traders make more informed decisions and potentially maximize their profits.

What are Earnings Reports?

Earnings reports are quarterly financial statements released by publicly traded companies. These reports provide a comprehensive overview of a company’s financial performance during a specific period, typically a quarter or a fiscal year. They include key financial metrics such as revenue, net income, earnings per share (EPS), and guidance for future performance.

Why Earnings Reports Matter

Earnings reports are essential because they offer insights into a company’s financial health and growth prospects. Investors and traders closely analyze these reports to gauge a company’s profitability and assess its potential for future growth. Positive earnings reports often lead to increased investor confidence, driving stock prices higher, while negative reports can result in a decline in stock prices.

Earnings Reports and Market Expectations

One critical aspect of earnings reports is how they compare to market expectations. Analysts and investors often have expectations regarding a company’s performance based on various factors such as industry trends, economic conditions, and company-specific news. When a company exceeds these expectations, it can lead to a surge in stock prices. Conversely, if a company falls short of expectations, it can trigger a sell-off.

Immediate Impact on CFD Stock Trading

Earnings reports can have an immediate and significant impact on CFD stock trading. When a company releases its earnings report, the market reacts swiftly. Traders closely monitor the report’s release time and analyze the data to make quick trading decisions. This can result in increased volatility and trading volumes, creating opportunities for short-term gains.

Volatility and Trading Opportunities

The heightened volatility surrounding earnings reports can be both a challenge and an opportunity for CFD traders. While increased price fluctuations can lead to potential profits, they also carry higher risks. Traders need to carefully assess the data and market sentiment to capitalize on these opportunities effectively.

Strategies for Trading on Earnings Reports

Successful CFD traders often employ specific strategies to trade around earnings reports. One common approach is the “straddle” strategy, where traders buy both a call option and a put option with the same strike price and expiration date. This strategy allows traders to profit from significant price movements, regardless of the direction.

Another strategy is the “strangle” strategy, which involves buying out-of-the-money call and put options. This strategy is suitable when traders anticipate substantial price movements but are uncertain about the direction. Both strategies require careful analysis and risk management.

Risk Management in Earnings Report Trading

While trading on earnings reports can be lucrative, it is essential to implement robust risk management practices. Setting stop-loss orders and position sizing are critical components of risk management. Traders should also avoid overleveraging and be prepared for unexpected market reactions.

Post-Earnings Report Analysis

After the initial reaction to an earnings report, traders should conduct a thorough post-earnings analysis. This involves reviewing the report in detail, assessing the company’s performance relative to expectations, and considering any forward guidance provided. Post-earnings analysis helps traders refine their strategies for future trades.

Long-Term Impact on Stock Prices

While the immediate impact of earnings reports is often the most noticeable, they can also have long-term implications for stock prices. Positive earnings trends can attract long-term investors, leading to sustained price appreciation. Conversely, repeated negative earnings reports can erode investor confidence and result in prolonged stock price declines.

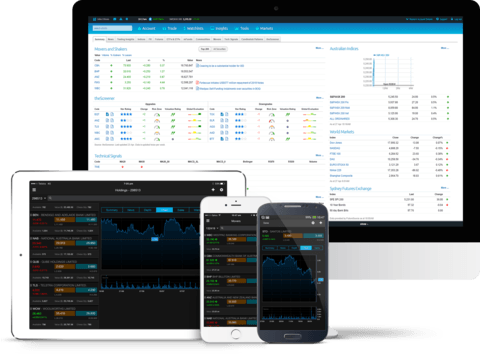

Leveraging Technology for Earnings Report Analysis

In today’s digital age, traders have access to advanced tools and technology that can enhance their earnings report analysis. Financial news platforms, trading software, and data analytics tools provide real-time information and insights. Utilizing these resources can give traders a competitive edge in making informed trading decisions.

Learning from Earnings Report Patterns

Experienced traders often look for patterns in earnings reports to predict future stock movements. For example, some companies consistently beat earnings expectations, while others frequently miss them. Recognizing these patterns can help traders anticipate market reactions and adjust their strategies accordingly.

Conclusion

Earnings reports play a pivotal role in CFD stock trading, offering valuable insights into a company’s financial performance and influencing market sentiment. By understanding the impact of earnings reports, traders can make more informed decisions, capitalize on trading opportunities, and manage risks effectively. Staying informed, analyzing data, and employing sound trading strategies are essential for success in the dynamic world of CFD stock trading.